Zscaler, Inc. (ZS) Q1 2024 Earnings Call Nov. 27, 2023

Here is a summary of the earnings call.

Jay Chaudhry - Chairman and CEO

Exceptional Financial Performance

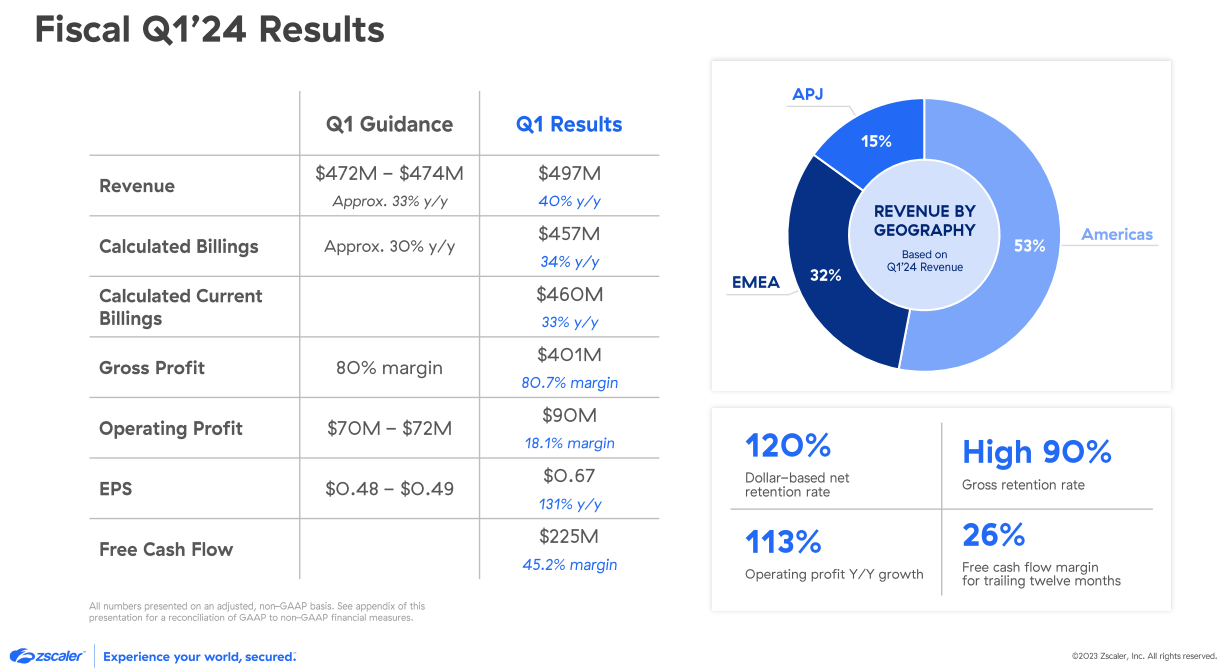

Revenue Growth: Achieved a remarkable 40% increase in revenue.

Billings Growth: Billings saw a substantial 34% growth.

Operating Profit and Free Cash Flow: Both metrics more than doubled compared to the previous year, indicating robust profitability.

Free Cash Flow Margin: Attained a record high of 45%, underscoring efficient cash management.

Sustained Operational Excellence

Rule of 60 Achievement: Surpassed the 'Rule of 60' for the 13th consecutive quarter, a significant feat for a company with over $2 billion in ARR.

This metric indicates a balance of growth and profitability.Strong New Logo Acquisition: Set a Q1 record in acquiring new logo customers, particularly those contributing over $1 million in ARR, illustrating the company's growing appeal to large enterprises.

Challenging Macro Environment: Despite a generally slower quarter and heightened scrutiny in large deals, Zscaler executed well, indicating resilience and adaptability.

Product and Platform Expansion

Increased Platform Adoption: Noted a trend of customers consolidating multiple point products into Zscaler's broader platform, driving up average deal sizes.

High Demand for Multiple Product Pillars: Nearly half of the new logo customers opted for all three key product pillars - ZIA, ZPA, and ZDX, reflecting the integrated value of Zscaler's offerings.

Dollar-Based Net Retention Rate: Achieved an impressive 120% rate due to strong upsells, indicating high customer satisfaction and loyalty.

Strategic Customer Wins and Vertical Expansion

Diversity in Customer Base: Wins spanned across many verticals, demonstrating the universal need for Zscaler's solutions.

Record U.S. Federal Quarter: New business in the U.S. federal sector grew by over 90% year-over-year, with four deals exceeding $1 million in ACV.

Zero Trust Security Adoption: Multiple U.S. federal agencies are standardizing on Zscaler, aligning with the President's executive order for Zero Trust security.

Key Customer Success Stories

Software Company Switch to Zscaler: A leading software company transitioned to Zscaler's Zero Trust Exchange Platform after facing challenges with a firewall-based single vendor SASE solution.

Hospitality and Gaming Industry Response to Breach: A major company in this sector adopted Zscaler's full suite for 25,000 users post a ransomware breach, showcasing the trust in Zscaler’s ability to protect against sophisticated cyber threats.

Strategic Leadership and Organizational Developments

Addition of Go-to-Market Leaders: Announced the appointments of two key leaders - Mike Rich as CRO and President of Global Sales, and Joyce Kim as CMO. These strategic hires are aimed at driving revenue, pipeline growth, and scaling the business.

Focus on Larger, Strategic Deals: Emphasized active engagement in large, multiyear, multi-pillar opportunities, a shift towards more substantial and long-term contracts.

Product Innovation and AI Integration

AI-Driven Security Features: Enhanced data and protection policies with AI and ML applications, focusing on protecting against Gen AI risks.

New Product Launches: Introduced Risk360 and breach predictor, leveraging AI models for risk quantification, mitigation, and predictive breach analysis.

Customer Adoption of Emerging Products: Noted significant customer adoption of ZDX, one of the newer pillars, for its unique ability to provide comprehensive visibility and root cause analysis.

Future Growth and Outlook

Expansion Beyond User Protection: While achieving success in user protection, Zscaler is also progressing in workload protection and IoT/OT protection.

Scaling Business Operations: With the new leadership in place, the focus is on scaling business operations to surpass $5 billion in ARR.

Long-Term Innovation Strategy: Continuing to push the boundaries of the platform, including extending it for B2B and 5G use cases and utilizing AI for insights and automation.

In conclusion, Zscaler's first-quarter results not only exceeded guidance but also demonstrated the company's strong position in the cybersecurity market.

With significant revenue and billings growth, a focus on large enterprise deals, and strategic leadership additions, Zscaler is well-positioned for continued innovation and expansion in the rapidly evolving cybersecurity landscape.

Remo Canessa - CFO

Q1 Financial Results Overview

Revenue: $497 million, a 40% increase year-over-year and 9% sequentially.

Geographic Revenue Distribution: Americas (53%), EMEA (32%), APJ (15%).

Federal Sector Performance: Best new ACV quarter ever, with over 90% growth year-over-year.

Billings and Contract Details

Total Calculated Billings: Grew 34% year-over-year to $457 million.

Sequential Billings Comparison: Declined 37% quarter-over-quarter due to a tough comparison with Q4's large upfront billing.

Contract Terms: Typically one to three years, with annual advance invoicing.

Calculated Current Billings: Increased 33% year-over-year, with a seasonal 32% quarter-over-quarter decline.

Remaining Performance Obligations (RPO): Grew 30% from the previous year to $3.49 billion.

Customer Metrics

$1 Million+ ARR Customers: Ended Q1 with 468 customers, adding 19 in the quarter.

$100,000+ ARR Customers: Entered the quarter with 2708 customers.

Net Retention Rate: 12-month trailing rate was 120%.

Gross Margin and Operating Expenses

Total Gross Margin: Stable at 80.7%, slightly down from 81.4% year-over-year.

Margin Influences: Higher public cloud usage for emerging products and accounting changes in asset depreciation.

Operating Expenses: Increased 11% sequentially and 26% year-over-year to $311 million.

Profitability and Cash Flow

Operating Margin: Reached 18%, an increase of approximately 620 basis points year-over-year.

Free Cash Flow Margin: 45%, including data center CapEx of about 6% of revenue.

Cash and Investments: Ended the quarter with over $2.3 billion.

Macro Environment and Fiscal Guidance

Macro Environment: Continues to be challenging, but customer sentiment is stabilizing.

Q2 Fiscal '24 Guidance: Revenue between $505 million to $507 million, operating profit between $84 million to $86 million, EPS between $0.57 to $0.58.

Full Year Fiscal '24 Updated Guidance: Revenue between $2.09 billion to $2.1 billion, billings between $2.52 billion to $2.56 billion, operating profit between $360 million to $365 million, EPS between $2.45 to $2.48.

Investment and Growth Strategy

Emerging Products Impact: Newer products like ZDX and Zscaler for workloads to initially have lower gross margins.

Aggressive Investment Plans: In sales, marketing, technology platform, and cloud infrastructure to capture market opportunities.

Long-term Growth Strategy: Focused on increasing profitability while aggressively investing to capitalise on significant market opportunities.

In summary, Zscaler's Q1 results surpassed guidance with strong growth in revenue, billings, and customer acquisitions, particularly in the federal sector.

The company is maintaining a prudent financial strategy in light of the challenging macro environment, balancing aggressive investments in growth with a focus on increasing profitability.

Q&A followed.

Anne Chapman

Dynamic Trader Twitter

Dynamic Trader LinkedIn

Let's go trade!