Two for Tuesday NU vs STNE

NU (Nubank) is on course to disrupt the banking industry in Brazil, Mexico and now Columbia. One way the disruption has been set is by offering many of the services that traditional banks provide through a simple app on the phone.

As the service is mainly conducted through an app, and not in a physical bank, the need for as much real estate and staffing requirement is far less than in traditional banking.

NU added 4.2 mln customers in Q4 2022 and with 74.6M customers globally - that is an increase of 38% YoY.

Full disclosure: We own NU.

STNE (StoneCo) offers electronic payment in Latin America.

The number of mobile phone users in that region is now greater than 60%, according to GSMA. This means the use and convenience of electronic payments is increasing rapidly - which in turn should begin to feature in their balance sheet.

With the number of mobile phone users increasing, the potential for growth is there.

STNE active payments clients increased by 46.3% from 1.8 million to 2.6 million.

Full disclosure: We do not own STNE.

So let’s compare the two stocks.

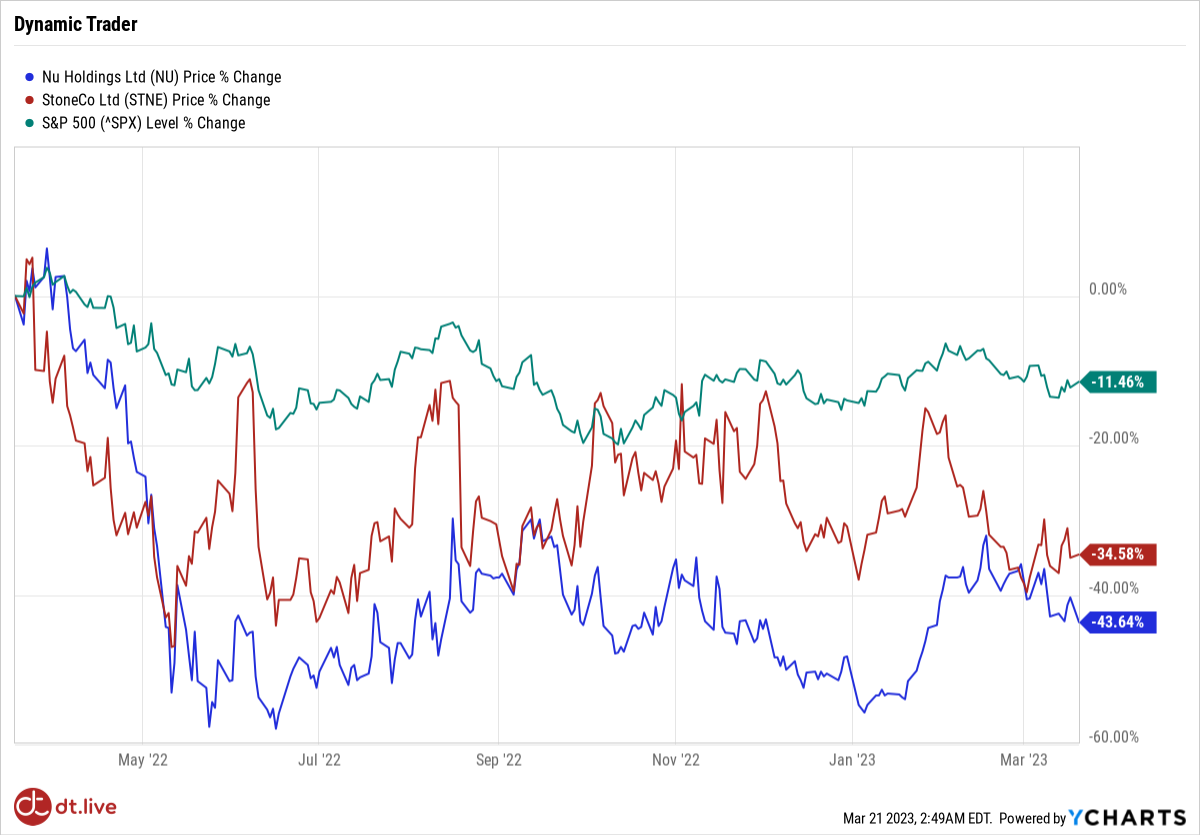

As NU went public more recently, and STNE went public three years prior, we will base the metrics on a one-year period.

Price

In the last one year, STNE price action has relatively outperformed that of NU.

But both have underperformed the S&P 500.

Fundamentals:

NU has had the greater revenue growth compared to the same quarter last year.

NU has had greater cash from operations.

NU quarterly Free Cash Flow is also greater than that of STNE.

NU once again is in the lead by covering its debt pretty easily.

Technicals:

Both stocks are currently stuck in some sideways activity and close to their daily 50 and 200 moving averages. While NU is above both moving averages, STNE is below both moving averages.

Conclusion:

Both companies have a lot to offer and with the uptake of mobile phones and more access to the internet on a daily basis, growth potential is there.

While our choice was to enter NU, we could just as easily have entered STNE. However, the metrics we used here and beyond currently favour NU at present.

Let's go trade!