Stock: THC vs SGRY

Tenet Healthcare (THC) is a sizable health-care oriented company focusing on the ownership and management of medical facilities. It has more than 465 ambulatory surgery centers and surgical hospitals, 61 hospitals and approximately 110 additional outpatient centers and other sites of care. The company was founded in 1975 and is headquartered in Dallas, TX.

The company is headed by CEO Saum Sutaria who previously held the position of Chief Operating Officer.

NASDAQ/MidCap/Industry: Health Care Providers

Surgery Partners, Inc. (SGRY) operates as a healthcare services company which is a leading operator of surgical facilities and ancillary services with more than 180 locations nationwide. The company was founded in 2004 and is headquartered in Brentwood, TN.

The company is headed by CEO Eric Evans, a Harvard graduate with over 15 years experience, who previously served as President of Hospital Operations for Tenet Healthcare (THC).

NYSE/MidCap/Industry: Health Care Providers

Price Growth (3yrs)

THC outperforms SGRY over 3 years.

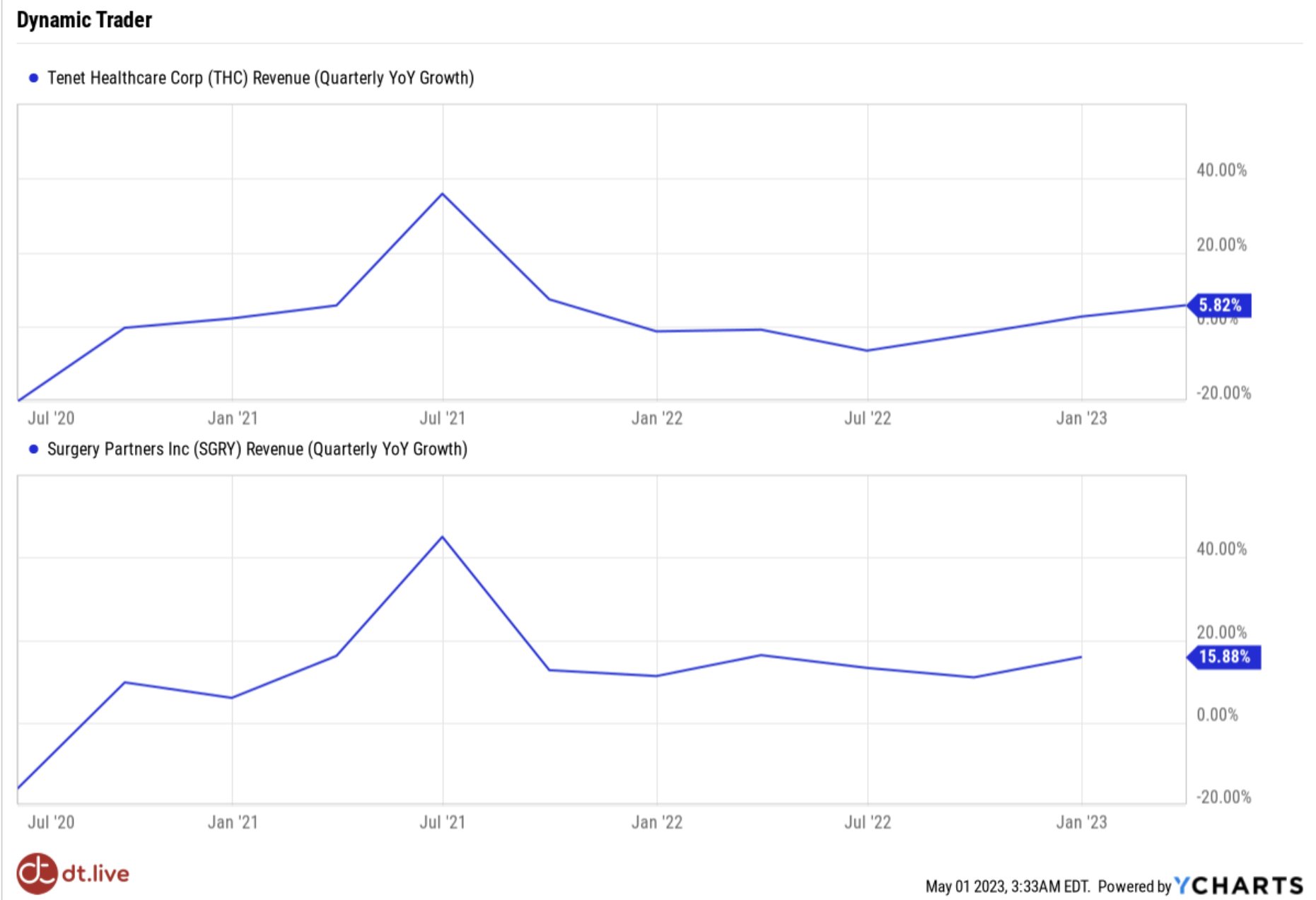

Revenue Growth:

The younger company SGRY is outperforming in this metric. Note: At the time of this post SGRY is due to report today.

Operating Margin:

SGRY is slightly ahead.

Free Cash Flow:

THC showing plenty of cash flow compared to the decline with SGRY.

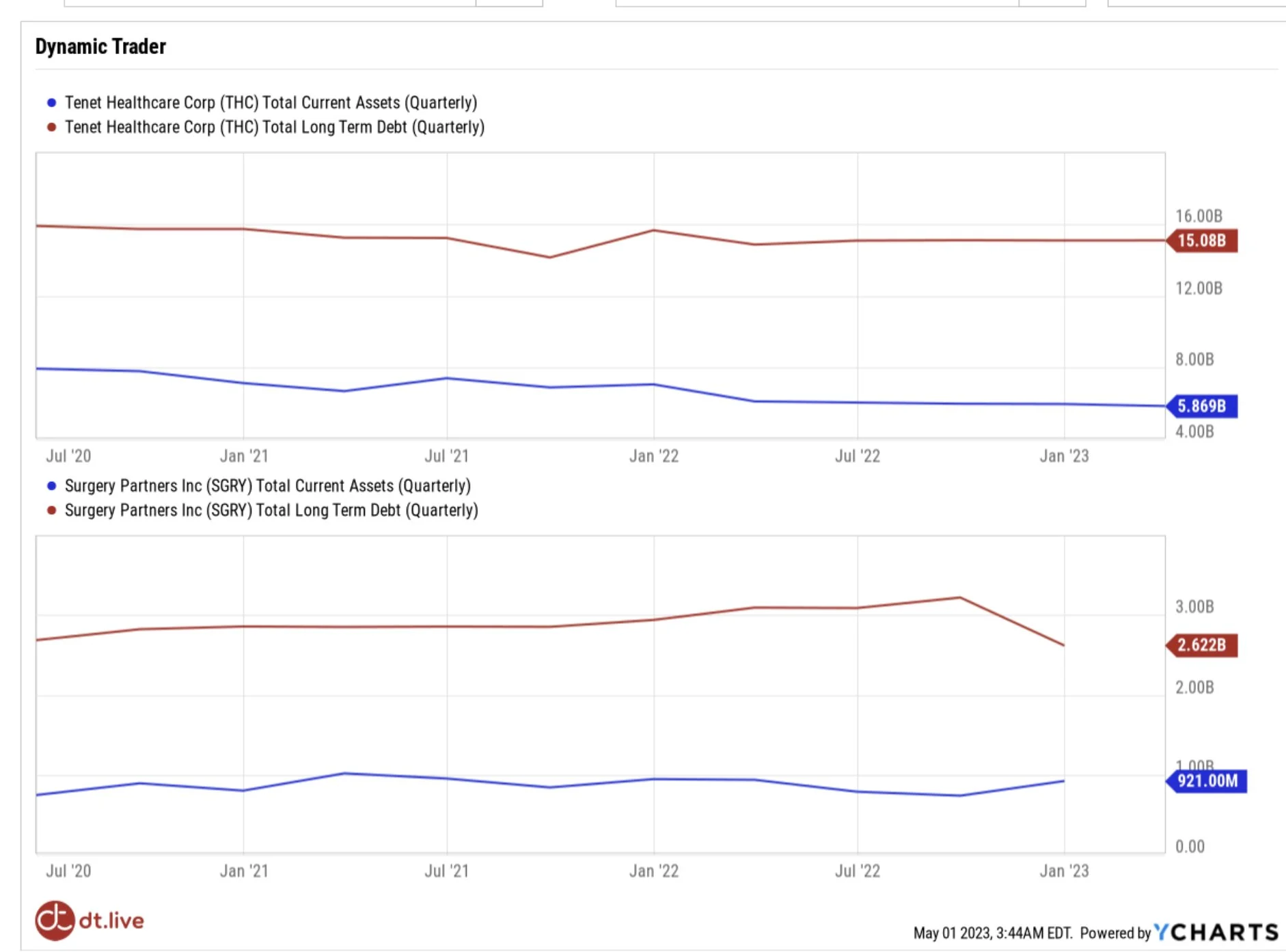

Debt vs Assets:

It is clear that THC can cover it´s long term debt. Regarding SGRY, the narrowing gap between assets and debt, along with a negative cash flow (above) may be a concern to the investor.

A $10k investment 3 years ago would have offered:

Noted by price growth the return is slightly more with THC.

Technicals:

The THC weekly chart showing a bottom formed around the 200 moving average.

The weekly chart of SGRY showing a similar structure to that of THC, a bottom close to forming around the 200 moving average.

I am looking forward to reading the earnings report for SGRY as it is the younger stock and has the potential for further growth. However, THC being the larger and well-established company, makes it an attractive value play.

Let's go trade!