Shift4 Payments, Inc. (FOUR) Q3 2023 Earnings Call Nov. 08, 2023

Here is a summary of the earrings call.

Jared Isaacman – Chief Executive Officer

Strong Quarterly Results:

Records across all Key Performance Indicators (KPIs), including end-to-end volume, gross revenue, gross profit, and adjusted EBITDA.

Margins and cash flow improving due to spread stabilization and disciplined expense control.

Notable achievements in Q3: 36% growth in end-to-end payment volume, 23% growth in gross revenue, 34% growth in gross profit, and 24% growth in gross revenue less network fees.

Adjusted EBITDA of $124.5 million, representing 46% YoY growth, with margins expanding by 780 basis points to 51.2%.

No Contribution from Recent Acquisitions:

Successful Q3 results achieved without contributions from recently announced stadium and resorts processing.

No revenue synergies realized yet from Finaro acquisition, which recently closed.

Potential for strong Q4 performance with enterprise accounts starting to process as expected.

Successful Capital Allocation Strategy:

Shift4 Payments sustains growth rates well above industry averages.

Organic growth alongside M&A strategy.

Organic investments include SkyTab POS and expansion into new verticals.

Strong track record in M&A, identifying technology assets to unlock embedded payments opportunities.

Approach is disciplined and focused on financial deleveraging within 24 months of acquisitions.

Unique M&A Approach:

Proprietary pipeline and processes for M&A.

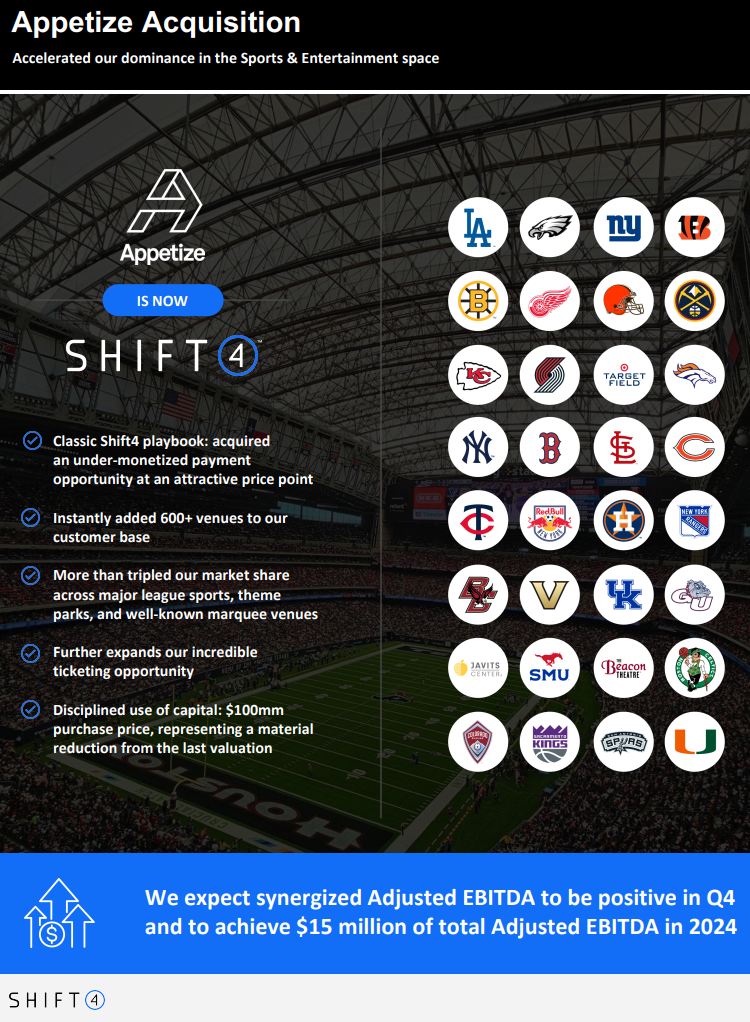

Recent acquisition of Appetize showcased Shift4's ability to secure deals even at a discount.

Shift4 leverages its strengths in technology and payment-related synergies to drive acquisitions.

M&A strategy aligns with the convergence of software and payments for a more valuable commerce experience.

Growth Algorithm:

Shift4's growth relies on "land and expand" and adding new merchants.

"Land and expand" strategy involves capitalizing on existing embedded payments opportunities within the customer base.

Success in converting gateway-only merchants to end-to-end and capturing opportunities in verticals like ticketing.

The other half of growth involves adding new merchants attracted to software integrations and unique offerings.

Restaurant Vertical Success:

Over 8,250 SkyTab POS systems installed in Q3.

Strong growth in the restaurant sector with competitive cost advantages.

Benefits from recent promotions and competitor challenges.

Thousands of new restaurants adopting SkyTab POS, expanding Shift4's presence.

Hotel Vertical Expansion:

Renewed and expanded relationships with prominent hotel clients.

Partnerships with Pebble Beach Resorts, Sonesta Hotels, and SkyTouch Technology.

Hotel wins include Ayres, Ocean House Hotel, Tiburón Golf Club and Resort, and Spinnaker Resorts.

Land and expand approach contributes to growth without adding new hotel customers.

Expansion into Sports & Entertainment:

Acquisition of Appetize expands market share within professional sports.

Success with the Orlando Magic, San Francisco 49ers, Miami Dolphins, and college sports venues.

Integration with Ticketmaster for primary ticket sales.

Unique offerings in mobile technology and ticketing positions Shift4 as a leader in the sports and entertainment vertical.

Nonprofit Vertical Momentum:

Partnership with Give Lively, powering donations for nearly 9,000 nonprofits.

Focus on offering diverse donation methods, including crypto and stock.

Integration with Ministry Brands and Endowment.

Cross-selling card processing capabilities within the nonprofit sector.

Retail Vertical:

Signed Landmark Rewards retail store in Philadelphia.

Expanding presence in the retail sector.

Completion of Finaro Acquisition:

Regulatory approval received for the European acquisition of Finaro.

Material revenue synergies unlocked during extended regulatory approval process.

Expansion into Europe and Canada with a focus on onboarding 10,000+ restaurants and hotels.

Excitement about international expansion opportunities.

Sustainable Growth Rates:

Demonstrated ability to gain share in end markets for over two decades.

Exceeding 2023 volume guidance, with strong growth rates sustained through effective capital allocation and execution.

Focus on automation, AI tools, and leveraging acquisitions to achieve strong margin and free cash flow performance.

Understanding of Integrated Payments Evolution:

Success attributed to understanding the evolving integrated payments landscape.

Capital allocation aligned with identifying talent and creating a motivated workforce.

Strong culture of competition and customer satisfaction.

Taylor Lauber – President and Chief Strategy Officer

Q3 Performance Overview:

Third-quarter volumes were in line with expectations despite the delayed closing of Finaro.

Same-store volumes varied among merchant groups: hotels saw modest growth, restaurants remained flat, and retail experienced moderate decline.

Encouraged for Q4 with the expectation of volume growth from ongoing projects and customers.

Gateway Sunset Initiative:

In the second year of the gateway sunset initiative, focus remains on migrating gateway customers to the end-to-end offering.

Roughly 50% of production and volume growth come from this migration, leading to a decline in gateway revenue but meaningful growth in end-to-end revenue.

Very little attrition in the gateway-only population under Shift4's management.

Finaro Acquisition's Positive Impact:

Initially sized at $30 million of EBITDA, Finaro's run rate EBITDA has exceeded $45 million.

Significant growth in the underlying business, with around 13% card-present transactions compared to 3% previously.

Approximately one-third of Finaro's revenue comes from Shift4's merchants.

Legacy Finaro expected to contribute $15 billion of total volume in 2024, along with $9 billion in payment volume from international opportunities.

Appetize Integration and Expectations:

Appetize is a business that has historically overlooked payments and burned cash extensively.

Expectation of a temporary step backward due to discontinued revenue share programs and a shift away from legacy revenue streams.

Confidence in the integration plan and positive conversations with Appetize customers eager to adopt the VenueNext platform and other benefits.

Anticipated margin drag to be short-lived, with a run rate EBITDA of $15 million by 2024.

Capital Allocation Priorities:

Prioritizing smaller M&A deals that align with the go-to-market strategy for restaurants, hotels, and stadiums in Europe.

Discipline in waiting for favourable selling multiples positions Shift4 well to deploy capital for attractive returns.

Commitment to opportunistic buybacks of the company's stock with excess free cash flow.

No apologies for past smart yet contrarian investments, including Focus POS, VenueNext, Appetize, and smaller investments like SpaceX, which have delivered attractive returns for shareholders.

Nancy Disman – Chief Financial Officer

Strong Q3 Financial Performance:

Q3 results include records for volume and gross revenue less network fees.

Balancing top-line growth with disciplined investments led to strong adjusted EBITDA margin and adjusted free cash flow conversion.

Key Financial Metrics:

Q3 volume increased by 36% YoY to $27.9 billion.

Gross revenue for Q3 grew by 23% to $675 million.

Gross revenue less network fees in Q3 increased by 24% to $243 million, as expected.

Q3 gross profit was up 34% YoY to $171 million, with a strong gross profit margin of 70%.

Spread and Margin Metrics:

The blended spread for Q3 was 64.5 basis points.

Anticipate average blended spreads around 65 basis points for the full year 2023.

Expect Q4 blended spreads to benefit from higher spread international volume and ticketing.

Core, including restaurants and hotels, continues to maintain stable blended spreads.

General and Administrative Expenses:

In Q3, total general and administrative expenses increased 3% YoY to $76.3 million.

Focused on keeping headcount flat while investing in talent upgrades and driving operational efficiency.

Adjusted EBITDA and Free Cash Flow:

Reported adjusted EBITDA of $124 million in Q3, up 46% YoY.

Q3 adjusted EBITDA margin was 51%, representing over 780 basis points of YoY expansion.

Q3 adjusted free cash flow was $76 million, bringing year-to-date adjusted free cash flow to nearly $200 million.

Balance Sheet and Leverage:

Exiting the quarter with over $690 million of cash, $1.75 billion of debt, and $100 million undrawn on the credit facility.

Net leverage at quarter-end was approximately 2.4 times.

Capital Allocation and Share Buybacks:

Board approved $250 million of buyback capacity, with over $150 million remaining.

Weighted average cost of debt is currently 1.35%, with no maturities until December 2025.

Updated Guidance:

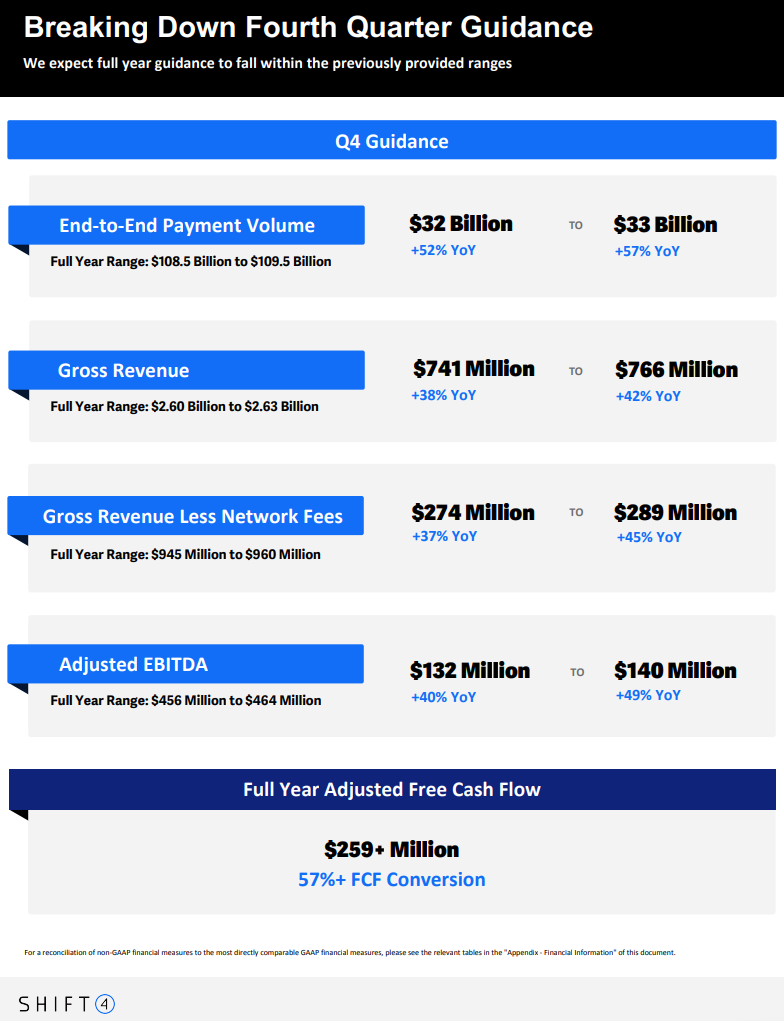

Tightening ranges for all key performance indicators (KPIs) and raising both low and high ends of adjusted EBITDA and adjusted free cash flow.

Q4 guidance includes end-to-end volumes of $32 billion to $33 billion, gross revenue of $741 million to $766 million, and gross revenue less network fees of $274 million to $289 million.

Anticipate adjusted EBITDA of $132 million to $140 million and adjusted free cash flow conversion to be at least 57%, up 500 basis points from initial guidance.

Factors for Q4:

Cautious outlook due to macroeconomic environment.

Closing of Finaro removes uncertainty around international expansion efforts.

Legacy M&A expected to contribute $25.6 million to gross revenue less network fees and $5.8 million to adjusted EBITDA.

Higher SaaS revenue from SkyTab POS installations, increased contribution from ticketing, and large hospitality and stadium wins anticipated in Q4.

2024 Volume Bridge:

Anticipate incremental volume from annualizing merchants boarded in 2023 and land-and-expand execution across verticals.

Total embedded payments opportunity of over $180 billion, with approximately 80% represented by gateway-only merchants.

Expect $15 billion of volume contribution from legacy Finaro.

Overall, Shift4 is positioned well, even in the current macroeconomic environment, due to the strong balance sheet, cash generation, and profitable growth.

Q&A followed.

Anne Chapman

Dynamic Trader Twitter

Dynamic Trader LinkedIn

Let's go trade!