Cloudflare, Inc. (NET) Q3 2023 Earnings Call Nov. 02, 2023

Here is a summary of the earnings call.

Matthew Prince - Co-Founder and CEO

Q3 Performance Overview:

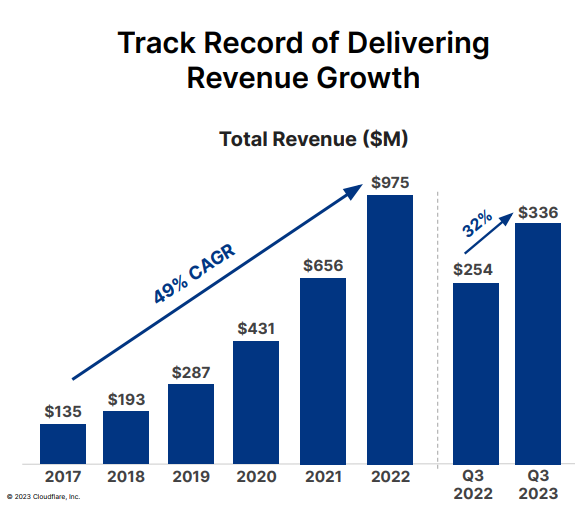

Achieved Q3 revenue of $335.6 million, up 32% YoY.

Added 206 new large customers (>$100,000/year), totalling 2,558 large customers, up 34% YoY.

Net retention increased 1% to 116%.

Go-to-Market Strategies:

Refined go-to-market strategies, maintaining pipeline close rates and sales force productivity.

Positive early signs from sales team additions in the past six months.

New cohort generated 1.6x higher pipeline compared to the previous year.

Achieved more than 130% of activity goals.

Financial Efficiency:

Gross margin remained strong at 78.7%, exceeding the target range.

Operating profit reached $42.5 million, marking the fifth consecutive record quarter.

Operating margin stood at 12.7%, almost tripling YoY.

Generated positive free cash flow of $34.9 million, with a margin of 10.4%.

Expected to generate over $100 million in free cash flow in 2023, ahead of the original goal.

Connectivity Cloud Concept:

Recognized Cloudflare as a "connectivity cloud" during the 13th anniversary.

Highlighted the contrast with first-generation clouds that hoard data.

Emphasized the importance of a connectivity cloud for connecting systems securely and efficiently.

Customer Wins:

Secured significant contracts with government agencies, healthcare, consulting, semiconductor, public utility, ad tech, and technology companies.

Highlights include replacing legacy solutions, consolidating point solutions, and providing comprehensive network-wide solutions.

Demonstrated expertise in privacy and regulatory compliance.

AI and Inference Expansion:

Accelerating efforts in AI with partnerships and infrastructure.

Introduced Workers AI to enable powerful AI inference close to users.

Deploying inference-optimized GPUs in 75 cities globally, aiming for 100 by the end of 2023.

Expecting widespread deployment of GPUs by the end of 2024, making Cloudflare a widely distributed cloud-AI inference platform.

Rapid adoption of AI capabilities by developers, with thousands leveraging the platform.

Growing customer interest in putting hundreds of billions of inference tasks on Cloudflare's infrastructure monthly.

Cybersecurity and Modern Warfare:

Recognizing the ongoing importance of staying ahead of global cybersecurity issues.

Acknowledging the role of cybersecurity in modern warfare and the cyber battlefield.

Thomas Seifert - CFO

Q3 Financial Performance:

Total revenue for Q3 reached $335.6 million, marking a 32% YoY increase.

Geographically, the U.S. contributed 52% of revenue (30% YoY growth), EMEA 28% (36% YoY growth), and APAC 13% (27% YoY growth).

Paid customer base grew by 17% YoY to 182,027 customers.

Large customers (spending over $1 million annually) increased by 34% YoY to a total of 2,558, with 206 added in the quarter.

Dollar-based net retention rate was 116% in Q3, up 100 basis points sequentially.

Financial Efficiency:

Gross margin in Q3 reached 78.7%, a 100 basis point increase sequentially and a 60 basis point increase YoY.

Network CapEx accounted for 8% of revenue, benefiting from infrastructure efficiency.

Despite investments in AI, network CapEx is expected to be 8% to 10% of revenue in fiscal 2023, returning to normalized levels over time.

Operating expenses represented 66% of revenue, with an 11% YoY increase in total employees.

Sales and marketing expenses were $129 million, representing 3% sequential and 38% YoY decrease as a percentage of revenue.

Research and development expenses were $54.2 million, with a 1% sequential and 18% YoY decrease as a percentage of revenue.

General and administrative expenses were $38.5 million, with a 2% sequential and 11% YoY decrease as a percentage of revenue.

Operating income was $42.5 million in Q3, a significant increase from $14.8 million in the same period last year.

Operating margin reached 12.7%, a 690 basis point YoY increase.

Net Income and Balance Sheet:

Net income in Q3 was $55.3 million, with a diluted net income per share of $0.16.

Ending Q3 with $1.6 billion in cash, cash equivalents, and available-for-sale securities.

Generated $34.9 million in free cash flow, equivalent to 10% of revenue.

Full-Year Guidance:

For Q4 2023, Cloudflare expects revenue between $352 million and $353 million, representing a 28% to 29% YoY increase.

Anticipates Q4 operating income in the range of $28 million to $29 million, with an effective tax rate of 7%, and diluted net income per share of $0.12.

Full-year 2023 revenue is projected to be in the range of $1.286 billion to $1.287 billion, reflecting a 32% YoY increase.

Full-year 2023 operating income is expected to be in the range of $110 million to $111 million, with a diluted net income per share of $0.45 to $0.46, and an effective tax rate of 8%.

Expects to generate over $100 million in free cash flow for the full year 2023.

Closing Remarks:

Emphasizes a commitment to operational excellence and delivering shareholder value.

Acknowledges the trust of customers in solving complex modernization challenges.

Highlights a focus on fiscal responsibility and being good stewards of investors' capital.

Q&A followed.